The New York-based fitness company announced plans earlier this month to lay off about 800 workers, raise the prices of its equipment, and outsource deliveries and some customer service functions. McCarthy’s general strategy is to rely more on partners to operate the business - a push that’s furthered by the Amazon arrangement. Investors will get more information on McCarthy’s comeback plans Thursday morning, when Peloton is due to report quarterly results.Īmazon provides Peloton with another way to work down its inventory pile-up, which it amassed as pandemic lockdowns faded.

In another effort to goose sales, Peloton is redesigning its bikes so customers can assemble them at home and will explore letting users beam its content to rival workout machines. He’s looking to reinvigorate sales, boost efficiency and restore some of Peloton’s former cachet. McCarthy, a tech veteran who took the helm in February, is trying to turn around a business that thrived during the early days of the pandemic but slowed drastically in the past year.

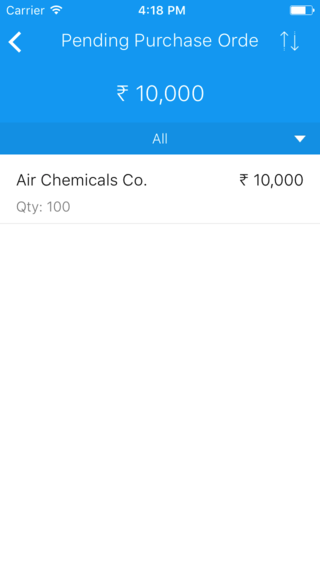

Amazon pending orders free#

“The pact should help boost Peloton’s top line, but - more importantly - trim distribution costs and help it turn free cash flow positive in fiscal 2023.” “Peloton’s retail partnership with in the US broadens its reach, though we don’t think of this as a precursor to M&A,” said Geetha Ranganathan, a Bloomberg Intelligence senior media analyst. But Peloton Chief Executive Officer Barry McCarthy has said that he’s not trying to sell the company. Before Wednesday, the stock had lost more than two-thirds of its value this year as the company struggled with slowing demand, an inventory build-up and strategy changes.Īmazon had previously been cited as a potential acquirer of Peloton - and investors pressed for such a deal earlier this year. The news sent Peloton shares up 20 per cent to US$13.48 in New York, the biggest one-day jump in more than six months. Until now, its wares have just been available via its website and retail showrooms. The move to open a US storefront on Amazon’s sprawling online marketplace will help Peloton expand its distribution and make products more readily available, the company said in a statement Wednesday.

as part of a turnaround plan, breaking with a longtime practice of selling products through its own channels.

rallied after agreeing to offer bikes and accessories on Inc.

0 kommentar(er)

0 kommentar(er)